J.D. Power Reports:

Small Businesses Place High Importance on Commercial Insurance Agents and Brokers Understanding Their Business and Helping Them Manage Risk

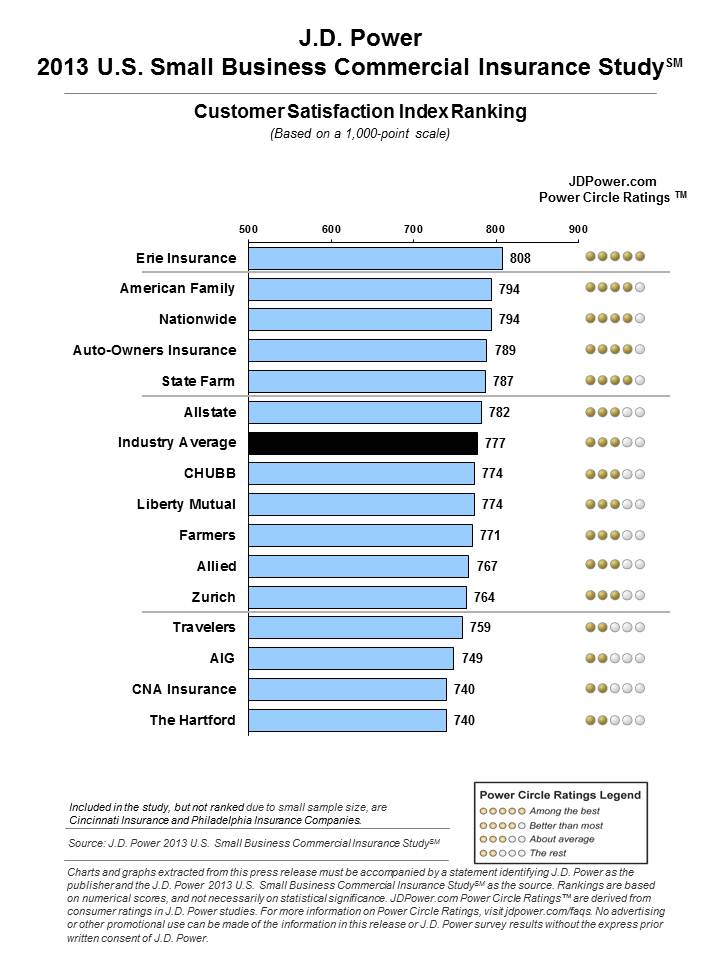

Erie Insurance Ranks Highest in Small Business Commercial Insurance Customer Satisfaction

WESTLAKE VILLAGE, Calif.: 3 September 2013 -- Small businesses most value having an agent or broker who completely understands their individual business and provides guidance in assessing and managing their risk. The highest-ranked insurers deliver on both of these metrics for 60 percent of their customers, compared with the lowest-ranked insurers at 33 percent, according to the J.D. Power 2013 U.S. Small Business Commercial Insurance StudySM released today.

The inaugural study

examines overall customer satisfaction, insurance shopping and purchase behavior among small business commercial insurance customers with 50 or fewer employees. Overall satisfaction is comprised of five factors (in order of importance): interaction; policy offerings; price; billing and payment; and claims.

|

Key Findings

- Overall customer satisfaction among small business customers is 777.

- Satisfaction is significantly higher when an agent or broker understands their customer's business and provides guidance regarding risk (835) than when neither of these metrics is met (645).

- Policy offerings--not price--is the primary reason small business customers select an insurer; level of service is the primary reason they stay with their insurer more than two years.

|

Overall customer satisfaction among small business customers is 777 (on a 1,000-point scale). Among the five factors impacting satisfaction, interaction has the highest importance weight at 29 percent, followed by policy offerings at 26 percent. Interaction satisfaction is highest when customers interact with an agent or broker in person (854). In contrast, satisfaction is significantly lower when customers interact via email (819).

Customer satisfaction is highest among small businesses with 11-50 employees, compared to businesses with four or fewer employees (790 vs. 769, respectively). Higher scores among larger businesses are influenced by agents and brokers spending more time with these key accounts. Agents and brokers are not only interacting with these larger businesses more frequently, but the interactions are also three times more likely to be made in person outside of the agent's office, compared to businesses with four or fewer employees (24% vs. 8%, respectively). Consultation via face-to-face interactions allows insurance agents to understand the customer's needs, provide helpful information regarding risk and tailor insurance products to meet their needs.

"Providing face-to-face consultation, from policy review to helping customers understand price adjustments initiated by the insurer, is crucial for customer retention and satisfaction," said Jeremy Bowler, senior director of the insurance practice at J.D. Power. "Those small business customers who have regular face-to-face contact with their insurance agents are more likely to understand their coverage, its value and the reason for a price adjustment should one occur. These customers are more likely to be satisfied and loyal to the insurance brand than those who don't have regular in-person interactions."

Bowler also noted that satisfaction is higher when insurers inform small business customers about price changes in person (823) than when they inform customers by phone (805) or email (783).

Policy offerings is an increasingly important driver of customer retention, especially for small businesses with 11-50 employees. The higher the employee count, the more important the product selection becomes. Nearly two-thirds (62%) of small businesses with 11-50 employees indicate policy offerings are a leading reason for retaining business with their insurer, compared with 50 percent of businesses with fewer than five employees.

Confidence that they're properly insured is of critical importance to small business owners, who need to understand the variety of insurance coverage options and know that the policy meets their needs. Among businesses customers who purchased their policy within the past two years, policy offerings, not price, is the most frequently cited reason for selecting their insurer.

"Small business customers who are highly satisfied with their insurer are more likely to work with just one insurance provider for all their insurance needs, as well as purchase more products, on average, from their carrier," said Bowler. "For example, highly satisfied customers average 5.4 products with their insurer, compared with 4.3 products for the least-satisfied customers."

Small Business Commercial Insurance Customer

Satisfaction Rankings Erie Insurance ranks highest among small business commercial insurers, with a score of 808. Erie Insurance performs particularly well in the interaction and policy offerings factors. American Family and Nationwide tie for second overall at 794 each. American Family performs particularly well in price, while Nationwide performs well in billing and payment.

The 2013 U.S. Small Business Commercial Insurance Study is based on 3,742 responses from insurance decision-makers in businesses with 50 or fewer employees that purchase general liability and/or property insurance. The study was fielded from April 2013 through July 2013.

About J.D. Power

J.D. Power is a global marketing information services company providing performance improvement, social media and customer satisfaction insights and solutions. The company's quality and satisfaction measurements are based on responses from millions of consumers annually. Headquartered in Westlake Village, Calif., J.D. Power has offices in North America, Europe and Asia Pacific. For more information on car reviews and ratings, car insurance, health insurance, cell phone ratings, and more, please visit

JDPower.com. J.D. Power is a business unit of McGraw-Hill Financial.

About McGraw Hill Financial

McGraw Hill Financial (NYSE: MHFI) is a leading financial intelligence company providing the global capital and commodity markets with independent benchmarks, credit ratings, portfolio and enterprise risk solutions, and analytics. The Company's iconic brands include: Standard & Poor's Ratings Services, S&P Capital IQ, S&P Dow Jones Indices, Platts, CRISIL, J.D. Power, and McGraw Hill Construction. The Company has approximately 17,000 employees in 27 countries. Additional information is available at

www.mhfi.com.

Media Relations Contacts:

Jeff Perlman; Brandware Public Relations; Woodland Hills, Calif.; (818) 598-1115;

jperlman@brandwarepr.com

John Tews; Troy, Mich.; (248) 680-6218;

media.relations@jdpa.com

Follow us on Twitter:

@JDPower

No advertising or other promotional use can be made of the information in this release without the express prior written consent of J.D. Power.

www.jdpower.com/corporate

# # #